Accountancy Saint Paul

United States Tax and FATCA Compliance

FATCA

In 2014, the United States implemented the Foreign Account Tax Compliance Act of 2010. FATCA requires both Americans and their foreign banks to report foreign assets to the US Treasury annually. Penalties for non-compliance have been set arbitrarily high, but the actual tax burden is manageable. Foreign residents can exclude a significant portion of their income, and use credits for foreign tax paid to reduce or eliminate their US liability.

Why File?

Annual penalties for failing to disclose foreign accounts start at $10,000 and increase to 50% of foreign account values, plus fees. Owners of undeclared foreign entities face similar penalties. When the IRS believes you owe more than $66,000 in unpaid tax your passport will be revoked and you can be detained at customs on re-entry.

Who?

American citizens and green card holders are required to file a tax return each year they receive the equivalent of $15,000 in regular income, or $400 in self-employment income.

Additional reporting requirements must be met if one's foreign account balances exceeded $10,000 at any point during the year, if one owned 10% or more of a limited liability entity based outside of the United States, or if one held more than $25,000 in investment funds (PFICs) domiciled outside of the US.

When?

Citizens and Permanent Residents qualify for special deadlines if their tax residence is outside of the United States. (IR-2017-105)

June 15, 2026. US citizens living overseas receive an automatic two month extension to file their taxes.

Foreign account holders who cross the $10,000 FBAR reporting threshold are required to file a separate report with the US Treasury by October 15th, 2026.

What to do?

The IRS will not impose penalties when the absence of liability is properly reported on a late return. Even if you have never filed, we can in most cases eliminate your US tax liability retroactively by claiming unused exclusions and foreign tax credits.

If you haven't already been contacted by the IRS you may still qualify for tax amnesty programs such as the "Streamlined Foreign Offshore Procedure" which waives the accumulated penalties for eligible U.S. taxpayers abroad.

All you have to do is file

Americans living in high-tax countries will pay no US income tax on foreign income. You just have to file.

Accountancy SAINT-PAUL

We prepare US returns for taxpayers who are subject to two (or more) tax regimes. We seek the best overall result, informed by obligations to the other tax regime(s) our clients are subject to. We do not prepare non-US (resident country) tax returns.

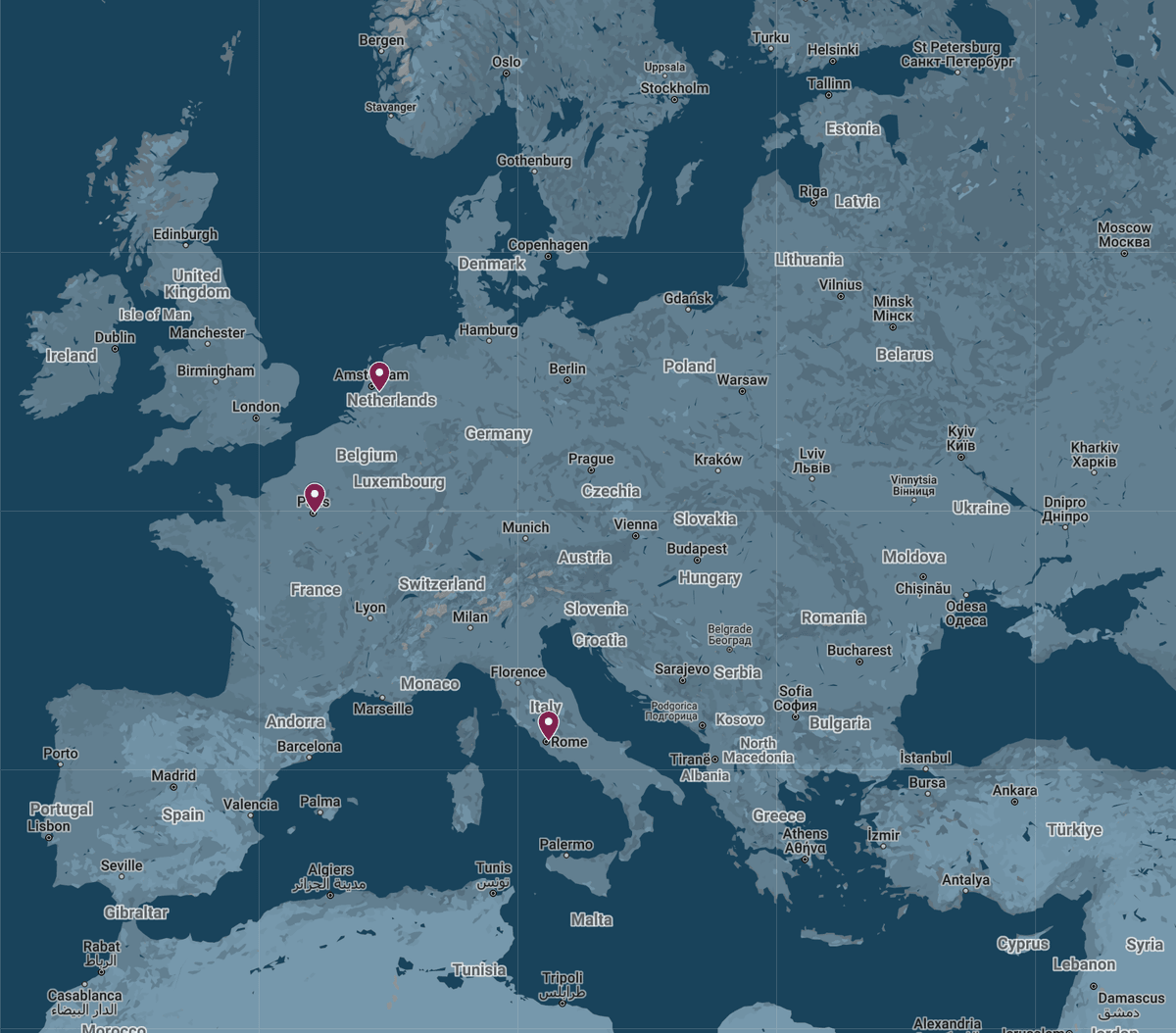

We serve clients in every European member state. Our workflow is entirely electronic, allowing everything to be completed online, regardless of your location. Data storage and transmission are protected by best-in-class encryption. Access is tightly restricted. Client files are never offshored or outsourced. All returns are prepared by in-house expat specialist US tax accountants based in Western Europe.

We accept new clients on a case-by-case basis. To inquire, please use the contact form to schedule an introductory call. All discussion is protected by tax practitioner-client privilege under IRC §7525. Please note that we do not accept unsolicited calls.

Michael de Sarro, EA, CAA

Principal

Member: American Chamber of Commerce Working Committee in Taxation, National Association of Enrolled Agents, National Association of Tax Professionals

Registered: US Dept of Treasury, Internal Revenue Service, NY Dept of Taxation and Finance, Financial Industry Regulatory Authority

Alumnus: University of California at Berkeley

France

+33 1 87 65 01 00

by appointment

16 Place de la Bourse

75002 Paris

Italy

+39 06 4754 2775

by appointment

Piazza Mincio, 2

00198 Rome

Netherlands

+31 35 369 0059

by appointment

Olympia 1B

1213NS Hilversum

CONTACT

To discuss your case, our process, likely outcomes, requirements, etc. please use the contact form below. For complex cases, we'll reply with options to schedule a phone conversation.

You can also email: clientservices@accountancysaintpaul.com

We do not prepare resident country tax returns.

We look forward to meeting you. Conversation will be protected by IRC §7525 client privilege. English spoken.

Pricing

Pricing is by form. We employ additional forms beyond those required only when their use activates additional credits, exclusions, exemptions, et cetera, and there is a net financial benefit to the taxpayer.

Clients of Accountancy Saint-Paul enjoy professional counsel throughout the year without additional fee. Representation before the IRS is billed hourly.

Typical Results by Income Category

AMERICANS IN FRANCE

Summary: In France you'll pay the same rates as anyone else living in France, which ensures there will be no tax left to pay in the states. There are, however, a number of generous provisions for US pensions in the Franco-American tax treaty.

Salary Income: $400k

(US or foreign source)

First 130k of earned income is excludable; Remaining US liability cancelled with credits for accrued French income tax and CSG/CRDS.

Result: 0 US Liability

Liquid Assets: $2MM

(US or foreign accounts)

The US does not have a wealth tax. Assets are non taxable, but when held in accounts outside of the US, each foreign account will need to be declared on FBAR and form 8938. Real property is exempt from reporting, as are many French tax-favored accts such as Livret A, PEE, LDD, etc.

Result: 0 US Liability

Realized Gain: $100k

(US or foreign broker)

Gains are taxed in France. Credit for accrued French income tax and CSG/CRDS is applied to cancel US capital gains tax. Unrealized gains remain untaxed unless held in PFICs (assurance vie.)

Result: 0 US Liability

Portfolio Income $40k

(US or foreign)

Bond, dividend and interest income is taxed in France. Credits for accrued French income tax and CSG/CRDS applied to cancel US tax.

Result: 0 US liability

Net Foreign Rental Income €60k

Rental income is taxed in France. Credits for accrued French income tax and CSG/CRDS are applied to cancel US tax.

Result: 0 US liability

Problem Areas

- Severance payments untaxed by France

- NIIT (pending appeal of Christensen v. United States)

AMERICANS IN ITALY

Summary: The availability of heavily discounted impatriate tax regimes enables real tax savings relative to other residents of Italy. This complicates the foreign tax credit calculus, but you are likely to pay less tax overall than if you stayed home.

Salary Income: $400k

(US or foreign source)

130k of earned income is excludable; Italy's Impatriate tax regime reduces IT taxable income by 50%, a credit from the reduced IT tax is applied to US liability, zeroing US liability before $420k, assuming MFJ status.

Result: 0 US Liability for incomes less than $420k, assuming no other income on discounted regimes

Liquid Assets: $2MM

(US or foreign accounts)

The US does not have a wealth tax. Assets are non taxable, but when held in accounts outside of the US, each foreign account will need to be declared on FBAR and form 8938. Real property is exempt from reporting.

Result: 0 US Liability

Realized Gain: $100k

(US or foreign broker)

Gains are taxed in Italy. Credit for accrued income tax is applied to cancel US capital gains tax.

Result: 0 US Liability

Bond Income $40k

(US or foreign)

Government Bond income is taxed at a reduced 12.5% rate in Italy. Even so, with the standard deduction, exclusions, and credits for other forms of passive income, there is often enough to work with to cancel the US liability on passive income.

Result: 0 US Liability for up to 160k of bond income, assuming no other income on discounted regimes

Retirement Income: $200k

Italy taxes IRA distributions and pension income. Credit for Italian tax paid is applied to cancel US liability.

Result: 0 US Liability

Problem Areas

- Self-Employment Tax (FICA) - Americans choose whether to pay social security to the US or Italy on net SE income

- NIIT (pending appeal of Christensen v. United States)

Questions & Answers

The Internal Revenue Code is complicated and the answers below are written to be general enough to set basic expectations in common situations, but they reflect careful application of the law by proper choice of form and method. We describe the result not the process. If you believe you are subject to exceptional circumstances and/or want to learn more about the details and how they could apply to you, send us a message or contact your tax advisor.

For US citizens living abroad, tax residency is the key determinant of where income is taxed, not the income's source or the payer's location. While Americans are always subject to US tax regulations on their worldwide income, their country of residence also has the right to tax that same income,...The Streamlined Foreign Offshore Procedure offers a limited-time opportunity to resolve past non-compliance for U.S. taxpayers living abroad. By filing three years of tax returns and six years of FBARs, qualified individuals can avoid substantial failure-to-file penalties, which can easily reach...W-9 is the form banks use to collect US citizen client's social security numbers in order to satisfy their FATCA reporting requirement. If you are current on your US tax and FATCA obligations and want to keep your account open, there is no reason not to return the completed w-9. If you are...American Citizens or Permanent Residents who declare earned income and have American Citizen children under 17, with social security numbers, are eligible to receive child tax credits with a maximum value of $2000 per qualifying child in 2025. The refundable part of the credit, ACTC, is worth up...The account values reported on the FBAR are not taxable income. The United States does not have a wealth tax. Only the interest, dividend or investment income from foreign accounts is taxable, and generally escapes US tax by the application of a credit for the foreign taxes paid on the same...It many cases it can actually be helpful to have a so-called "Non-Resident Alien" Spouse. The primary advantage is that the spouse's income is neither reported nor taxable in the United States.Services

UNITED STATES TAX COMPLIANCE FOR ANY BUSINESS OR INDIVIDUAL SUBJECT TO THE US TAX SYSTEM

INDIVIDUALS

- US tax reporting of foreign income, foreign assets, foreign businesses, foreign pensions and tax-favored accounts, foreign inheritance & gifts, and foreign gains (IRS Form 1040)

- FATCA/FinCEN reporting for individuals (W-9, W-8BEN, FBAR, FinCEN 114)

- Tax projection and forecasting

- Exemption of income by treaty (8833)

- American investors in passive foreign investment companies and mutual funds (PFIC 8621)

- Dual-status returns and Nonresident returns (1040NR)

- Nonresident alien spouse complications (NRA)

- US tax ID issuance for foreign persons (ITIN W-7)

- Streamlined foreign offshore procedures (14653)

- Streamlined domestic offshore procedures (14654)

- Accidental Americans (SFOP 14653)

- US Citizenship renunciation (8854)

- US Citizenship relinquishment (DS-4079)

- Relief procedures for certain former citizens (8854)

BUSINESSES

- US corporate tax (1120-C, 1120-S)

- American control of foreign corporations (CFC 5471)

- American control of foreign passthrough entities, partnerships, and real estate companies (FPE 8858, 8865, 8832)

- Foreign corporations with US source income (1120-F)

- Nonresident control of US corporations (5472)

- FATCA classification and reporting for foreign individuals and entities (W-8BEN, W-8BEN-E)

- 401k plans abroad (5500)

- US TIN issuance for foreign corporations (EIN SS-4)

- Reconciliation to US GAAP

- Bureau of Economic Analysis - BEA benchmarks (BE-10A, BE-10B, BE-10C, BE-10D, BE-10 Exemptions)

- Beneficial ownership reporting (BOI)

VIGILANTIBUS NON DORMIENTIBUS ÆQUITAS SUBVENIT.

Equity favors the vigilant, not those who sleep on their rights.

Copyright © 2026 Accountancy Saint-Paul, LLC. All rights reserved. No part of this webpage may be reproduced, distributed, or transmitted in any form or by any means without the prior written permission of the copyright owner. Legal action may be taken if unauthorized use is identified.